Existing-home sales are up and down—falling most recently in April, according to NAR data—as tight inventory and mortgage rates create uncertainty.

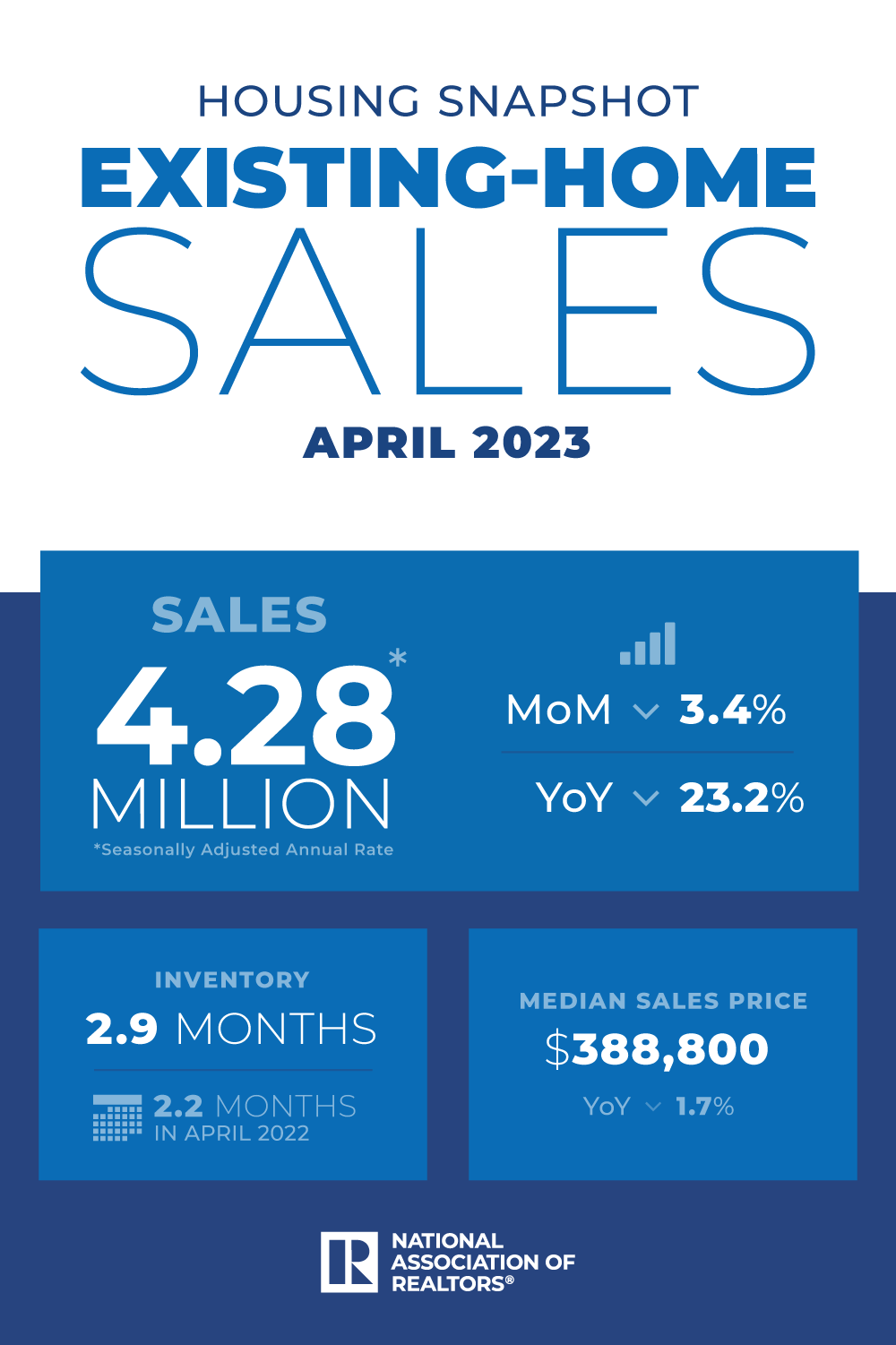

Existing-home sales fell last month as the spring real estate market remains fluid and sensitive to the ongoing inventory shortage and changing mortgage rates. Existing-home sales, which include completed transactions for single-family homes, townhomes, condos and co-ops, dropped 3.4% month over month in April and were down 23% from a year earlier, the National Association of REALTORS® reported Thursday.

But new-home sales are a bright spot as buyers turn to new construction for more housing options in a market with bare-bones inventory. Builder incentives, such as mortgage rate buydowns, also are attracting buyers who are looking for some kind of affordability relief.

“The combination of job gains, limited inventory and fluctuating mortgage rates over the last several months have created an environment of push-pull housing demand,” says NAR Chief Economist Lawrence Yun. “Home sales are bouncing back and forth but remain above recent cyclical lows.”

Home prices are being impacted by that dynamic as well. The median price for an existing home among all housing types in April dropped 1.7% compared to a year earlier, reaching $388,800, NAR reports. Prices last month rose in the Northeast and Midwest but fell in the South and West.

“Roughly half of the country is experiencing price gains,” Yun says. “Even in markets with falling prices, primarily the expensive West region, multiple-offer situations have returned in the spring buying season following the calmer winter market. Distressed and forced property sales are virtually nonexistent.”

Here’s a closer look at more key indicators from NAR’s latest existing-home sales report:

- Housing inventory: Inventory has increased this spring but remains historically low. Total housing inventory was at 1.04 million units at the end of April, up 7.2% from March and 1% from a year earlier. Unsold inventory is at a brisk 2.9-month supply at the current sales pace.

- Days on the market: Seventy-three percent of homes sold in April were on the market for less than a month. Properties typically remained on the market for 22 days, down from 29 days in March but up from just 17 days a year earlier.

- First-time home buyers: First-time buyers are making up slightly more home sales this spring. They comprised 29% of sales in April, up slightly from 28% in March. Faced with competition and quick sales, first-time home buyers accounted for just 26% of home sales in 2022, the lowest since NAR began tracking such data.

- All-cash sales: All-cash sales comprised 28% of transactions in April, up from 27% in March and 26% a year earlier. Individual investors and second-home buyers tend to make up the biggest bulk of cash sales; they purchased 17% of homes in April, matching year-ago levels.

- Distressed sales: Foreclosures and short sales continued to account for historically low levels of the market—just 1% of sales in April, unchanged from the previous month and year.

Regional Breakdown

Here’s how existing-home sales fared across the country in April:

- Northeast: Sales dropped 1.9% from March, reaching an annual rate of 510,000. Sales are down nearly 24% from a year ago. Median price: $422,700, up 2.8% from the previous year.

- Midwest: Sales fell 1.9% from one month ago, reaching an annual rate of 1.02 million. Sales are down 21.5% from the prior year. Median price: $287,300, up 1.8% from April 2022.

- South: Sales decreased 3.4% compared to March, reaching an annual rate of 1.98 million. That marks a 20.2% decline from one year ago. Median price: $357,900, down 0.6% from April 2022.

- West: Existing-home sales fell 6.1% compared to March, reaching an annual rate of 770,000. Sales are down 31.3% from the previous year. Median price: $578,200, down 8% from April 2022.

Source: nar.realtor