A strong job market and consumer credit are driving up mortgage rates for the third consecutive week and now to their highest level in six weeks. Mortgage rates are 0.82 percent higher than a year ago—the largest year-over-year increase since May 2014, Freddie Mac reports.

Despite the higher rates, Sam Khater, Freddie Mac’s chief economist, expects buyer demand to remain high. “This spectacular stretch of solid job gains and low unemployment should help keep home buyer interest elevated,” Khater says. “However, mortgage rates will likely also move up, as the Federal Reserve considers short-term rate hikes this month and at future meetings.”

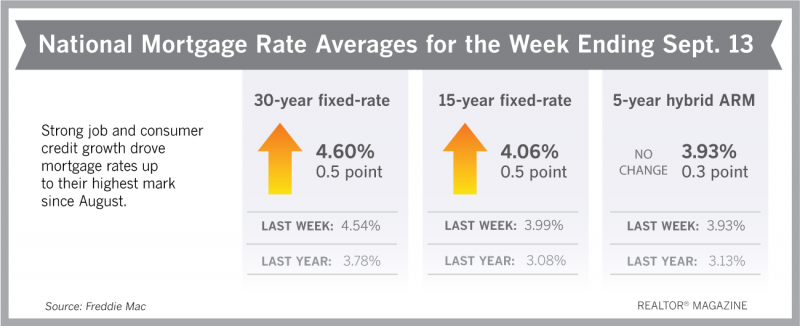

Freddie Mac reports the following national averages with mortgages rates for the week ending Sept. 13:

- 30-year fixed-rate mortgages: averaged 4.60 percent, with an average 0.5 point, up from last week’s 4.54 percent average. Last year at this time, 30-year rates averaged 3.78 percent.

- 15-year fixed-rate mortgages: averaged 4.06 percent, with an average 0.5 point, climbing from last week’s 3.99 percent average. A year ago, 15-year rates averaged 3.08 percent.

- 5-year hybrid adjustable-rate mortgages: averaged 3.93 percent, with an average 0.3 point, unchanged from last week. A year ago, 5-year ARMs averaged 3.13 percent.

Source: