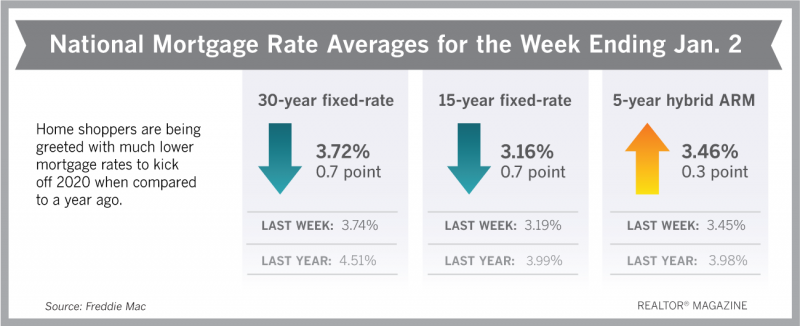

Home shoppers are being greeted with much lower mortgage rates to kick off 2020 than they were a year ago. The 30-year fixed-rate mortgage averaged 3.72% this week, compared to 4.51% at the beginning of 2019.

Improving economic data has led to a stability in mortgage rates over the last few weeks. Thirty-year rates have generally hovered around an average of 3.7% for the past two months.

What a difference a year makes: “The stability is welcome news after the interest rate turbulence of the last year, which caused a slowdown in the housing market and other interest rate-sensitive sectors,” says Sam Khater, Freddie Mac’s chief economist. “The low mortgage rate environment combined with the red-hot labor market is setting the stage for a continued rise in home sales and home prices.”

Freddie Mac reports the following national averages with mortgage rates for the week ending Jan. 2:

- 30-year fixed-rate mortgages: averaged 3.72%, with an average 0.7 point, falling slightly from a 3.74% average a week ago. Last year at this time, 30-year rates averaged 4.51%.

- 15-year fixed-rate mortgages: averaged 3.16%, with an average 0.7 point, dropping from last week’s 3.19% average. A year ago, 15-year rates averaged 3.99%.

- 5-year hybrid adjustable-rate mortgages: averaged 3.46%, with an average 0.3 point, rising slightly from a 3.45% average last week. A year ago, 5-year ARMs averaged 3.98%.

Source: Freddie Mac