Mortgage rates keep falling after Powell tries to deflate expectations for the spring rate, as 3 new reports released this week suggest the economy is, in fact, losing steam

Mortgage rates continue to retreat from 2023 highs, but homebuyer demand for purchase loans remained flat last week, as for-sale inventories are still tight in many markets and prices remain out of reach of some would-be buyers.

Demand for purchase mortgages was down 0.3 percent last week from the week before, after seasonal adjustments, the Mortgage Bankers Association (MBA) reported Wednesday. The MBA’s Weekly Mortgage Applications Survey found purchase loan demand was down 17 percent from a year ago.

With mortgage rates back to levels not seen since August, refinancing is starting to make sense for some homeowners again, driving refi requests up 14 percent last week compared to the week before, and 10 percent from a year ago.

“Refinance applications saw the strongest week in two months, increasing on a year-over-year basis for the second consecutive week for the first time since late 2021,” MBA Deputy Chief Economist Joel Kan said, in a statement. “The overall level of refinance applications is still very low, but recent increases could signal that 2023 was the low point in this cycle for refinance activity, consistent with our originations forecast.”

The MBA lender survey showed mortgage rates declined last week to the lowest level since August 2023.

Mortgage rates continue retreat from peaks

Borrowing costs have continued to slide, with rates on 30-year fixed-rate loans falling below 7 percent this week for the first time since Aug. 10, according to daily rate lock data tracked by Optimal Blue. At 6.99 percent Tuesday, rates on 30-year fixed-rate loans have come down 84 basis points from a 2023 peak of 7.83 percent registered on Oct. 25.

Rates keep falling as fresh inflation data pours in, with investors who fund most mortgages convinced the Federal Reserve will begin lowering rates in the spring to avoid a recession and guide the economy to a “soft landing.”

At an appearance at Spelman College on Friday, Fed Chair Jerome Powell tried to deflate rising expectations that the central bank might begin lowering interest rates soon, saying, “It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease.”

But mortgage rates kept falling this week as three new reports were released suggesting the economy is, in fact, losing steam:

- Private sector employment increased by a less-than-expected 103,000 jobs in November and annual pay was up 5.6 percent year-over-year, according to the latest ADP National Employment Report, released Wednesday.

- Job openings fell in October to the lowest level since March 2021, according to the U.S. Department of Labor’s monthly Job Openings and Labor Turnover Survey (JOLTS), released Tuesday.

- Economic activity in the services sector expanded in November for the 11th consecutive month, according to the Institute for Supply Management’s latest Services ISM Report On Business, also released Tuesday.

But the small rise in the November ISM services survey, to 52.7 from 51.8, follows two straight declines, forecasters at Pantheon Macroeconomics noted.

“Spending growth in the services sector is softening, at the margin, but the overall rate of growth remains relatively healthy, though whether that will last as the pool of excess savings runs out and wage growth slows is another question,” Pantheon economists said in a report to clients.

The CME FedWatch Tool, which tracks futures markets to predict the odds of the Fed’s next moves, showed investors see a 61 percent chance that the Fed will implement one or more cuts in the federal funds rate by March 20, and an 87 percent chance of one or more rate cuts by May 1.

With bond market investors increasingly convinced the Fed will lower rates in the spring, yields on 10-year Treasurys, a barometer for mortgage rates, touched a three-month low of 4.11 percent Wednesday.

Powell “effectively confirmed Friday what everyone in markets has assumed for some time — and as we have been saying since the July hike — namely, the Fed is done,” forecasters at Pantheon Macroeconomics said in their Dec. 4 U.S. Economic Monitor report to clients.

“Powell himself has made the general point several times that lower inflation pushes up real rates and so could trigger a reduction in nominal rates, but he is not yet ready to endorse a timetable implying spring rate cuts,” Pantheon forecasters said. “We think he will get there. We have long expected the first easing in March, and we’re happy markets are now with us. The economy does not need higher real rates, and the Fed will ease in order to prevent that from happening.”

How low can mortgage rates go?

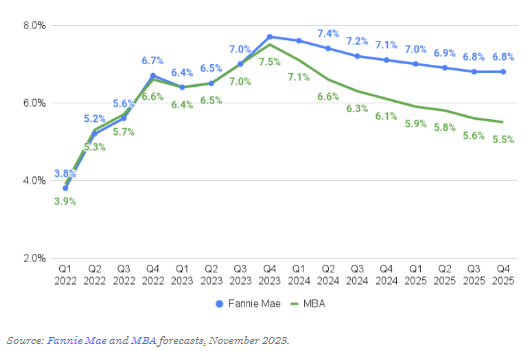

In a Nov. 17 forecast , MBA economists predicted that mortgage rates will fall to the mid-6 percent range by the end of next year and drop into the mid-fives by the end of 2025.

In their Nov. 21 forecast, economists at Fannie Mae still saw the Fed pursuing a higher for longer rate strategy, which they predict will keep mortgage rates above 7 percent next year.

Mortgage lending expected to pick up next year

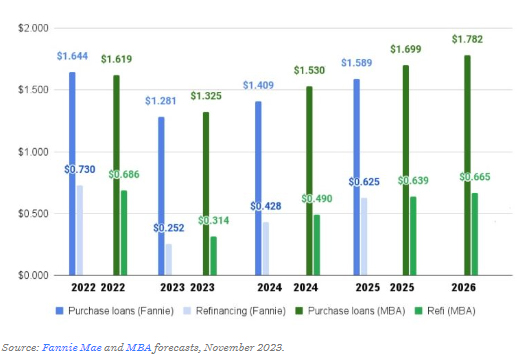

MBA economists also said that while they see purchase loan originations growing by just 15 percent next year, to $1.53 trillion, they see refinancing originations growing by 56 percent next year, to $490 billion.

Fannie Mae forecasters on Nov. 13 predicted more modest growth in purchase loans (10 percent in 2024), but expect refinancing originations to grow by 70 percent next year, to $428 billion.

Source: inman.com